What Is GRC & Risk Management Platforms?

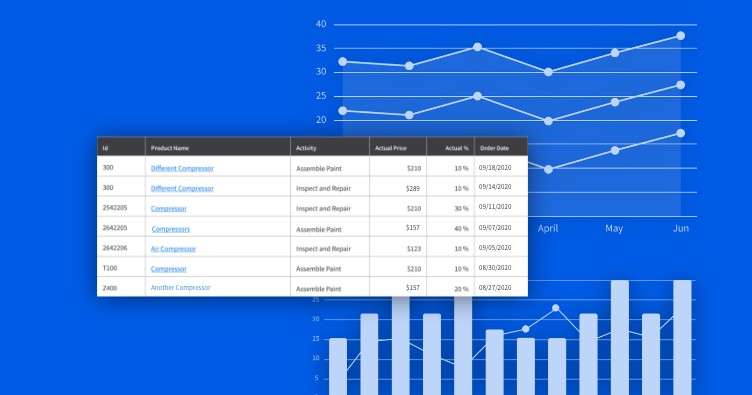

Governance, Risk, and Compliance (GRC) platforms are integrated software systems designed to unify an organization's approach to managing regulatory obligations, enterprise risk, and internal governance policies. Unlike point solutions that address a single mandate—such as a standalone anti-money laundering (AML) tool or a dedicated safety incident tracker—a true GRC platform serves as the central nervous system for organizational integrity. It aggregates data from disparate business units to provide a "single source of truth" regarding the organization's risk posture and compliance status.

This category covers software used to manage the non-financial risk lifecycle across the enterprise: identifying and assessing risks (strategic, operational, cyber), mapping internal controls to regulatory frameworks, automating evidence collection for audits, and reporting on compliance gaps. It sits between Security Operations (which focuses on technical threat detection) and Legal/General Counsel workflows (which focus on contract and litigation management). It includes both broad, enterprise-grade "integrated risk management" suites and specialized, vertical-specific tools built for highly regulated sectors like healthcare, manufacturing, and financial services.

The core problem these platforms solve is the fragmentation of risk data. In the absence of a GRC platform, organizations typically rely on "spreadsheet silos"—disconnected Excel files, emails, and shared folders where critical compliance evidence goes to die. This fragmentation makes it impossible for leadership to see the aggregate impact of risk or to respond quickly to regulatory changes. By centralizing these functions, GRC platforms allow organizations to shift from a reactive "check-the-box" mentality to a proactive stance known as principled performance—reliably achieving objectives while addressing uncertainty and acting with integrity.

History of GRC Software

The modern GRC software market did not exist meaningfully before the early 2000s. Prior to this, risk management was largely a manual discipline governed by paper trails and burgeoning spreadsheet ecosystems. The catalyst that birthed the formal GRC software category was the Sarbanes-Oxley Act of 2002 (SOX). Following massive corporate accounting scandals (e.g., Enron, WorldCom), the US government mandated strict internal controls over financial reporting. Suddenly, large enterprises needed a way to document, test, and attest to thousands of internal controls. The first generation of GRC software, often referred to as "GRC 1.0," emerged to fill this gap. These were heavy, on-premise databases focused almost exclusively on financial compliance and audit trails. They were expensive, rigid, and despised by end-users for their complexity.

By the late 2000s and early 2010s, the market entered a consolidation phase. Large ERP and IT management vendors acquired niche GRC players to bundle compliance modules into their existing stacks. However, this often resulted in "Frankenstein" suites—disjointed codebases stitched together under a single brand name. During this period, the definition of GRC expanded beyond financial controls to include IT security risks, driven by the rise of cyber threats and new frameworks like ISO 27001. This era, "GRC 2.0," began the shift toward Integrated Risk Management (IRM), a term popularized by analysts to describe a more holistic, technology-centric view of risk that extended beyond the legal department into IT and operations.

The current era, beginning around 2015-2018, is defined by the cloud revolution and the rise of vertical SaaS. Buyers grew tired of the six-figure implementation costs and multi-year rollout timelines associated with legacy GRC 1.0 platforms. A new wave of cloud-native vendors emerged, offering faster deployment and user interfaces that didn't require a Ph.D. to navigate. Simultaneously, the explosion of third-party SaaS vendors created a new crisis: Vendor Risk Management (VRM). Organizations realized their perimeter was porous, and they needed tools specifically to assess the security of their supply chain. Today, the market is bifurcating into two distinct directions: massive, all-encompassing enterprise platforms leveraging AI to predict risk, and agile, domain-specific tools (e.g., automated SOC 2 compliance for startups) that solve immediate pain points with high automation.

What to Look For

Evaluating GRC platforms requires a cynical eye. The market is awash with "consultingware"—software that looks like a product but requires endless hours of paid professional services to configure. When assessing vendors, prioritize the following critical criteria to separate true software platforms from empty shells.

Critical Evaluation Criteria:

- Content Libraries and Framework Maps: The platform should come pre-loaded with the specific regulatory frameworks you need (e.g., NIST, GDPR, HIPAA) and, crucially, should maintain these mappings. If a regulation changes, does the vendor update the control map, or is that your job? Look for "common control" capabilities, where one internal control (e.g., "password complexity") satisfies requirements across multiple frameworks simultaneously, adhering to the "test once, comply many" principle.

- No-Code Configurability: Workflows for risk assessments and incident reporting should be editable by business analysts, not developers. If changing a field on a risk intake form requires a ticket to the vendor's engineering team, the platform will become a bottleneck.

- Automated Evidence Collection: In 2025, manual screenshots are unacceptable. The platform must offer native integrations (APIs) to your core systems (HRIS, Cloud Infrastructure, Identity Providers) to automatically pull evidence of compliance. For example, it should automatically check your cloud provider daily to verify that database backups are encrypted, rather than asking an engineer to upload a screenshot every quarter.

Red Flags and Warning Signs:

- "Custom Implementation" as a Standard: If the vendor quotes an implementation fee that exceeds 50% of the annual license cost, you are likely buying a toolkit, not a solution. High implementation ratios suggest the product is not ready out-of-the-box.

- Module Fatigue: Be wary of pricing models where every minor function (e.g., "Policy Management" vs. "Document Management") is a separately priced module. This often leads to ballooning costs as your program matures.

- Legacy UI/UX: If the demo looks like a spreadsheet from 2005, user adoption will fail. GRC relies on frontline employees reporting incidents and completing assessments. If the interface is hostile, they will bypass it, leaving you with "shadow risk."

Key Questions to Ask Vendors:

- "Can you show me the exact workflow for updating a control when a regulation changes, and who is responsible for that update?"

- "What percentage of your customers are live on the current version of the software?" (Low numbers indicate difficult upgrade paths).

- "Does the platform support bi-directional syncing with our ticketing system (e.g., Jira), or is it a one-way push?"

Industry-Specific Use Cases

Retail & E-commerce

For the retail sector, GRC is dominated by supply chain continuity and consumer data protection. Retailers manage vast networks of third-party vendors, from logistics providers to payment processors. A generic GRC tool often fails here because it lacks the specific vendor risk assessment templates required for deep supply chain tiers. Retailers specifically need platforms that can visualize "fourth-party" risk—the risks posed by their vendors' vendors. Furthermore, compliance with the Payment Card Industry Data Security Standard (PCI DSS) is non-negotiable. The ideal platform for retail automates the collection of evidence for PCI audits across hundreds of store locations and e-commerce endpoints. Evaluation priority should be placed on high-volume vendor intake workflows and integration with Point-of-Sale (POS) network management tools to monitor for tampering or data exfiltration risks.

Healthcare

Healthcare GRC is uniquely high-stakes due to the convergence of patient safety and data privacy (HIPAA). Unlike other industries where a risk event means financial loss, in healthcare, it can mean life or death. GRC platforms here must bridge the gap between IT security (protecting Electronic Health Records) and clinical operations (ensuring medical devices are patched and safe). Specific needs include Business Associate Agreement (BAA) management—tracking the legal compliance of every vendor that touches patient data. [1] Recent data indicates that healthcare organizations are disproportionately targeted by third-party breaches, making the "Vendor Risk" module of a GRC platform critical. Evaluators should look for platforms that offer pre-built HIPAA audit protocols and the ability to map IT controls directly to patient safety outcomes.

Financial Services

Financial services firms face the most aggressive regulatory environment, navigating operational resilience mandates like DORA (Digital Operational Resilience Act) in the EU and various stress-testing requirements globally. [2] GRC in this sector is not just about compliance; it is a mechanism to manage regulatory capital and avoid massive fines. These institutions require "Model Risk Management" capabilities—validating the algorithms used for credit scoring or trading—which generic platforms rarely offer. Furthermore, they need granular "Three Lines of Defense" architecture, separating operational management (1st line), risk/compliance oversight (2nd line), and internal audit (3rd line) within the software permissions. Evaluation should focus on the platform's ability to handle high-frequency regulatory changes (Regulatory Change Management) and its capacity to quantify risk in monetary terms (Risk Quantification) to justify capital reserves.

Manufacturing

In manufacturing, the critical differentiator is the convergence of Information Technology (IT) and Operational Technology (OT). [3] A GRC platform must account for risks not just in the corporate email server, but in the PLCs and SCADA systems on the factory floor. Standard IT GRC tools often lack the asset classes for industrial control systems. Manufacturing buyers need tools that support Health, Safety, and Environment (HSE) workflows alongside cyber risk. For instance, a risk assessment in this sector might combine physical safety hazards (e.g., chemical spills) with cyber-physical threats (e.g., a hacker altering a robotic arm's parameters). The evaluation priority is "Cyber-Physical Risk" mapping and offline capabilities for conducting audits in facility areas with poor connectivity.

Professional Services

For law firms, accounting firms, and consultancies, the primary GRC driver is client mandate compliance. These firms hold sensitive data for hundreds of other companies, meaning they are constantly bombarded with security questionnaires from their clients. [4] The "Security Questionnaire Fatigue" in this sector is real and costly. A generic GRC tool that only manages internal risk is insufficient; professional services firms need platforms with "Trust Centers" or automated questionnaire response capabilities (using AI to answer RFPs based on previous security audits). The workflow that sets this niche apart is the ability to tag specific data sets or assets to specific client contracts, ensuring that if a client leaves, their data is governed according to their specific retention policies (Client Data Governance).

Subcategory Overview

Governance, Risk & Compliance (GRC) Tools for Property Managers

This niche is genuinely distinct because the "risk" managed is physical and contractual rather than purely digital. Unlike generic GRC tools that focus on cyber controls or financial audits, our guide to GRC tools for Property Managers highlights software designed to handle Certificate of Insurance (COI) tracking for hundreds of tenants and vendors. A generic platform would require massive customization to track lease-specific insurance expiration dates across a multi-property portfolio. The specific workflow only these tools handle well is the automated syncing of tenant screening data with fair housing compliance checklists, ensuring that every lease approval meets regulatory non-discrimination standards. Buyers are driven to this niche by the pain of "COI gaps"—discovering a vendor is uninsured only after an accident occurs on the property.

Governance, Risk & Compliance (GRC) Tools for SaaS Companies

SaaS companies face a unique "existential compliance" hurdle: they cannot sell to enterprise clients without a SOC 2 or ISO 27001 attestation. General-purpose GRC tools are often too slow and heavy for agile engineering teams. As detailed in our guide to GRC tools for SaaS Companies, this subcategory focuses on Continuous Compliance Automation. The specific workflow these tools master is "code-to-compliance" mapping: automatically scanning GitHub repositories and AWS configurations to prove to auditors that change management procedures were followed, without developers ever logging into the GRC tool. The specific pain point driving this purchase is the need to shorten sales cycles; SaaS startups cannot afford the 6-12 month implementation time of legacy GRC suites when a major deal is contingent on a clean SOC 2 report.

Governance, Risk & Compliance (GRC) Tools for Marketing Agencies

Marketing agencies handle a toxic asset: other people's customer data. The risk profile here centers on Privacy Governance (GDPR, CCPA) and AdTech compliance. Generic GRC platforms rarely have deep functionality for cookie consent scanning or marketing vendor tag management. Our guide to GRC tools for Marketing Agencies explores solutions that bridge the gap between legal policy and marketing execution. One workflow unique to this niche is the automated scanning of client websites to detect unauthorized tracking pixels that violate privacy consent strings—a technical nuance generic risk tools miss entirely. The driving pain point is "agency indemnity": agencies are increasingly being asked to indemnify clients against privacy lawsuits, driving them to specialized tools that can prove rigorous consent management.

Governance, Risk & Compliance (GRC) Tools for Consulting Firms

Consulting firms often act as "Virtual CISOs" (vCISO) for multiple clients simultaneously. They don't just need to manage their own risk; they need to manage risk for 50 different clients from a single dashboard. Our guide to GRC tools for Consulting Firms focuses on Multi-Tenancy. A generic GRC platform is usually single-tenant; a consultant cannot easily toggle between "Client A" and "Client B" without logging out or mixing data. The specialized workflow here is the "template rollout": creating a standard risk policy once and deploying it instantly to 20 client instances. The pain point is "spreadsheet scalability"—consultants eventually hit a wall where managing 30 different clients' risk registers in Excel becomes an operational liability.

Governance, Risk & Compliance (GRC) Tools for Contractors

Contractors operate in a world of Health, Safety, and Environment (HSE) regulation that digital-first GRC tools ignore. Our guide to GRC tools for Contractors covers platforms mobile-optimized for field use. The workflow only these tools handle well is the "Site Induction" process—verifying a subcontractor's safety certifications and conducting a digital safety briefing on a mobile device before they are allowed through the physical site gates. Generic GRC tools assume users are at desks; contractor tools assume users are wearing gloves and holding tablets. The driving pain point is "site access liability"—if an uncertified worker enters a site and is injured, the compliance failure is immediate and physical, not theoretical.

Integration & API Ecosystem

In the modern GRC landscape, integration is not a feature; it is the entire ballgame. Legacy platforms often touted a "single pane of glass" that was, in reality, a data graveyard where information had to be manually entered. Today's ecosystem relies on bi-directional APIs. [5] Experts note that "API integrations allow firms to view all risk and compliance related data centrally and ensure a single source of truth." However, integration is also a major point of failure. The sheer volume of connections required—HR systems for personnel, Cloud for infrastructure, Jira for remediation—creates a "fragile mesh" of dependencies.

Expert Insight: A common statistic cited in API security research suggests that poor API governance is a primary attack vector, with unmanaged APIs accounting for a significant percentage of security incidents. GRC platforms must not only consume APIs but secure their own connections.

Scenario: Consider a 50-person professional services firm. They attempt to connect a mid-market GRC tool to their invoicing system (QuickBooks) and project management tool (Asana) to track profitability risks. A poorly designed integration might pull all project data rather than just the relevant metadata. The result? The GRC platform becomes bloated with gigabytes of irrelevant task descriptions, slowing the system to a crawl and breaking the "risk dashboard" that was supposed to provide clarity. The firm ends up with a sync error loop that requires manual CSV exports to fix, defeating the purpose of automation.

Security & Compliance

Ironically, the software used to manage security is itself a massive target. Buyers must scrutinize the data residency and encryption standards of the GRC vendor. Since these platforms house the "keys to the kingdom"—details of every vulnerability and control gap in your organization—a breach here is catastrophic. [6] SecurityScorecard reports that 35.5% of all breaches in 2024 originated from third-party vendors, highlighting the critical nature of securing the supply chain, including the GRC vendor itself.

Expert Insight: As noted by Gartner analysts, data sovereignty is becoming a top priority. European clients may legally cannot use a GRC platform that replicates backup data to US servers, regardless of the encryption level.

Scenario: A healthcare provider selects a GRC platform to manage HIPAA compliance. The vendor claims to be "HIPAA compliant" but, upon closer inspection of their SOC 2 Type II report, the buyer discovers the vendor uses a sub-processor for customer support chat that resides in a non-compliant jurisdiction. If the healthcare provider had pasted patient data into a support ticket, they would have triggered a reportable breach. This highlights the need to audit the GRC vendor's own vendor map, not just their top-level security claims.

Pricing Models & TCO

GRC pricing is notoriously opaque and complex. The two dominant models are Module-Based (pay per function, e.g., Audit, Risk, Vendor) and User-Based (pay per seat). [7] Industry data suggests that for enterprise solutions, implementation costs can range from $75,000 to over $500,000, often eclipsing the annual license fee. Buyers frequently underestimate the Total Cost of Ownership (TCO) by ignoring the "soft costs" of administration.

Expert Insight: "With legacy players, the cost of licensing can be just 20% of the total cost of ownership," warns one pricing analysis. The remaining 80% is consumed by consulting fees, internal administration, and paid upgrades.

Scenario: A hypothetical 25-person compliance team buys a user-based platform at $150/seat/month. The annual license is $45,000—seemingly affordable. However, the vendor charges for "read-only" users who need to answer risk surveys. The company needs to survey 200 operational staff. Suddenly, the vendor requires an upgrade to an "Enterprise" tier to allow unlimited read-only access, tripling the cost to $135,000. Additionally, the platform requires a dedicated administrator to build workflows, consuming 50% of a full-time employee's salary ($60,000). The true TCO year-one is closer to $200,000, blowing the budget apart.

Implementation & Change Management

Implementation is where GRC projects go to die. [8] Gartner predicts that through 2027, 80% of data governance initiatives will fail due to a lack of alignment with business outcomes. The "Shelfware" risk is high; organizations buy a Ferrari and use it like a skateboard because they failed to map their processes before turning on the software.

Expert Insight: Forrester analysts emphasize that "organizations struggle to complement day-to-day activities with a strategic perspective," often leading to GRC implementations that digitize bad processes rather than fixing them.

Scenario: A manufacturing firm implements a top-tier GRC platform to manage safety incidents. They decide on a "Big Bang" rollout, switching all 10 factories to the new system on January 1st. The system is configured by HQ without input from the plant floor. On launch day, factory foremen realize the mobile app requires a stable Wi-Fi connection to save a report—Wi-Fi that doesn't exist in the remote warehouses. Adoption drops to zero. The firm is forced to revert to paper forms for six months while re-engineering the app for offline mode, wasting the license fee for half a year.

Vendor Evaluation Criteria

Beyond features, buyers must evaluate the viability and partnership model of the vendor. Is the vendor venture-backed and burning cash, or profitable and stable? In the volatile SaaS market, a vendor bankruptcy can leave your compliance data stranded.

Expert Insight: Market reports indicate a shift where buyers are prioritizing "customer success" and "community" over raw feature sets. A vendor with a vibrant user community often provides better support than a dedicated rep.

Scenario: A mid-sized bank evaluates two vendors. Vendor A has every feature but poor G2 reviews regarding support responsiveness. Vendor B lacks one advanced reporting module but has a "white glove" onboarding guarantee. The bank chooses Vendor A. Six months later, a critical bug prevents them from generating a regulatory report due the next day. Support takes 48 hours to respond. The bank misses the regulatory deadline and faces a fine. The "superior features" of Vendor A were rendered useless by the lack of operational support.

Emerging Trends and Contrarian Take

Emerging Trends 2025-2026:

- Agentic AI in GRC: We are moving beyond "generative" AI (writing policy drafts) to "agentic" AI—autonomous agents that can execute tasks. [9] Predictions for 2026 suggest GRC teams will use intelligent agents for "continuous risk monitoring" and "automated decision support," fundamentally changing the analyst's role from data gatherer to strategic overseer.

- The Death of the Annual Audit: The market is shifting toward "Continuous Control Monitoring" (CCM). Instead of an annual panic to gather evidence, platforms are maintaining a "live" state of compliance, potentially rendering point-in-time audits obsolete in favor of real-time trust dashboards.

Contrarian Take:

The mid-market is profoundly overserved and overpaying for GRC. The vast majority of mid-sized companies ($50M-$500M revenue) are buying enterprise-grade "Integrated Risk Management" platforms when they essentially need a robust task manager with a content library. They are sold a vision of "AI-driven predictive risk analytics" that requires a level of data maturity they simply do not possess. [10] As analysts have noted, the complex "Waves" and "Quadrants" often lead buyers to "project confusion and failure" by pushing them toward complex tools they aren't ready for. Most of these businesses would see a higher ROI from hiring one dedicated risk analyst to manage a simple tool than buying a $100k platform that requires three people to feed it data.

Common Mistakes

Overbuying Features ("Feature Bloat"): Buyers often select the platform with the longest feature list, assuming they will "grow into it." In reality, complexity is the enemy of adoption. A platform with 50 modules will likely confuse users, leading to them ignoring the system entirely.

Ignoring the "First Line of Defense": GRC tools are often bought by the Risk Team (2nd Line) for the Risk Team. However, the data comes from the business operations (1st Line). If the tool is not designed with the end-user experience in mind (e.g., the sales rep logging a gift, the engineer logging a change), the data quality will be garbage. [11] Industry surveys highlight that engaging the first line is critical, yet often overlooked.

Poor Data Taxonomy: Implementing a tool without first agreeing on what a "risk" is versus an "issue" or an "incident" leads to chaos. If Department A calls a server outage an "incident" and Department B calls it a "risk," the platform cannot aggregate the data meaningfully. Software cannot fix a broken dictionary.

Questions to Ask in a Demo

- "Show me the process for a frontline employee to report a risk. Count the clicks." (If it's more than 5, adoption will be low).

- "Can I create a custom report without exporting data to Excel or paying for a professional services engagement?"

- "How does your platform handle a conflict between two regulations (e.g., GDPR data deletion vs. financial record retention)?"

- "Demonstrate the API connector for [Your Critical System]. I want to see it pull live data, not a slide deck saying it works."

- "What is the average time-to-value for a customer of my size? Not 'implementation time,' but time until the first risk report is generated."

Before Signing the Contract

Final Decision Checklist:

- Scope Creep Protection: Ensure the contract defines "users" and "assets" clearly. Some vendors charge by "assets in the database"—if you sync your entire cloud asset list, your bill could explode 10x overnight.

- Exit Strategy: What happens to your data if you leave? Demand a clause that guarantees a structured data export (in a usable format like CSV/JSON) at the end of the term without punitive fees.

- SLA on Content Updates: If you are buying the tool for regulatory libraries, ensure there is a Service Level Agreement (SLA) on how quickly they update the library after a new law is passed (e.g., within 72 hours).

Deal-Breakers:

- Lack of API Documentation: If they won't let you see the API docs before signing, they are hiding complexity.

- Proprietary Data Formats: If you can't get your data out easily, you are trapped.

- No Sandbox Environment: Never sign without a trial or at least a sandbox period to test a specific workflow with your own data.

Closing

Navigating the GRC market requires looking past the shiny dashboards to the plumbing underneath. The right tool is the one that fits your organization's maturity today, with just enough headroom for tomorrow. If you need help cutting through the noise or want an objective second opinion on your shortlist, feel free to reach out.

Email: albert@whatarethebest.com